To be able to invest in the stock market, a person needs to open an account via a stockbroker or online share dealing platform.

Today’s lesson will consider what is the best online stock broker in the UK for your requirements.

You will then be able to trade stocks and shares via this broker or online platform.

Opening a stock dealing account is easy.

This lesson will look at the different stock brokers / online share dealing platforms available to investors in the UK.

At first glance, choosing the right stock broker / online share dealing platform can seem like a daunting task. However, it can be broken down into a few important criteria:

- Cost – One of the biggest things to take into consideration when buying (and selling) shares is how much it’ll cost you in fees and charges. The main ones to look out for are: dealing fees, account fees, inactivity fees, and exit fees. Dealing fees are the fee you pay each time you buy or sell shares. Account Fees is normally a monthly fee, quarterly or annual fee you pay to your platform provider for assets under management – it can be a flat fee or a % fee based on your portfolio value. Inactivity fees are increasingly rare but some providers charge them unless you make a certain number of trades within a set period. Exit fees are the fees you pay to move your portfolio from one provider to another.

- Ease of use – You want a broker that meets your requirements in terms of ease of trading. Some offer online-only share dealing via an app, others offer telephone dealing whilst certain brokers offer a combination of these.

- Speed and reliability – You want your broker to be able to execute your trades in a quick and simple manner whilst also offering you tight spreads to ensure you don’t overpay.

- Market availability – Different brokers and platforms offer differing market coverages. With some brokers, one is able to only invest in UK shares whilst other brokers have much wider availability in terms of being able to invest in most shares across the developed world.

- Information availability – Some brokers offer information and data to help in your research process whilst others offer an execution-only service where no such data is provided. In today’s world, most of the data can be found for free over the internet.

- Customer Service – Different brokers and platforms offer differing levels of customer service. You want one that is tailored to your needs. Platforms with higher customer service ratings tend to charge more.

- Customer Satisfaction – What other customers think of the product offered, check out Trustpilot and Reviews.io.

- Security – This should be a high priority as after all you are dealing with your life savings. First, ensure you are dealing with a reputable stockbroker which is regulated by the Financial Conduct Authority (FCA). When entering any type of personal information on your online broker’s website, make sure you see that you are on a secure network, which will be evident if you see http: replaced by https: before the URL. You should also read and understand the site’s security policy, which usually includes guarantees to protect your account against any security breach or fraud.

One needs to look at all the above criteria in order to decide on which party to use when buying shares. Different providers have different strengths and weaknesses. You need to choose the provider that is best for your specific circumstances.

Generally speaking, a company that provides a higher level of services such as up-to-date market research and information will be more expensive than one that does not.

So if you would rather go and research a company via your own means as opposed to using your platform’s market research, there is no point paying the higher costs associated with the more expensive but greater market research broker.

The Different Online Share Dealing Platforms Available

There are a number of online stock brokers to choose from. Some of the most popular online share dealing platforms in the UK are: (in no particular order)

- Freetrade

- Hargreaves Lansdown

- Youinvest

- Interactive Investor

- iweb-sharedealing.co.uk

- x.o.co.uk

- share.com

- Degiro

- Best Invest

- ig.com

- Trading 212

- Barclays Smart Investor

- Halifax

- HSBC

- Shareview.co.uk

Comparing Different Online Stock Brokers

Let’s take a look look at some of the share dealing platforms that really stand out from the above list.

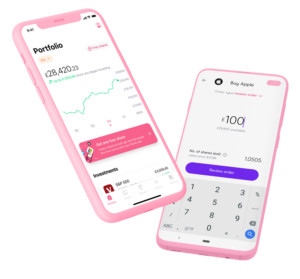

Freetrade – This is my favourite online stockbroker right now, and the one I would recommend to beginners starting out. You can check out my full Freetrade review here. It is a commission fee-free platform. This means investors using Freetrade are able to buy and sell shares for ZERO dealing charges.

Advantages of Freetrade:

- Low cost – The biggest advantage is the free dealing offering. Not having to pay commission for buying or selling shares will save a lot of money and enhance returns.

- User friendly – The product is a mobile app that makes investing natural and accessible. Current solutions in the UK feel bloated, unusable, and business-minded. The Freetrade app is slick, simple, and aesthetically pleasing.

- Easy to build a diversified portfolio with small amounts. I personally know many people who want to start investing but don’t have sufficient funds to do so. Now people could invest with as little as £1.

By way of example, a traditional stockbroker charges £10 a trade. If you buy a share worth £20 and you pay a £10 dealing charge, your total cost is £30. You are already down £10 or over 30%. You would need for your stock to climb 33% just for you to break even. On the other hand, if you buy a stock worth £20 and have no dealing charge to pay, you are in the money as soon as the stock starts moving upwards. This is why no dealing charges are a huge thing for smaller cash-strapped investors. Dealing fees on the other hand do not matter for investors buying £20,000 worth of stock at a time as the £10 fee only makes up 0.05% of the purchase price.

- No hidden costs – Freetrade wants to be a transparent provider with no hidden costs.

Disadvantages of using Freetrade are:

- Smaller range of stocks – Freetrade does not have the widest selection of stocks at present but says that they have over 5,000 stocks, funds and unit trusts to choose from. This is more than enough for the average investor and they are expanding their selection daily.

There is currently a promotion running for new users. Anyone who signs up with my link, funds their account – can be as little as £1 will get a free share – and complete a W8-BEN form on the app will receive a free share worth up to £200.

Hargreaves Lansdown – HL is the biggest funds platform in the UK It is one of the most respected platforms amongst private investors. It has great ease of use, speed, reliability, market coverage, customer service, customer satisfaction and information availability. But this all comes at a cost. It is one of the pricier options among the do-it-yourself investment platforms.

Advantages of Hargreaves Lansdown are :

- Hargreaves Lansdown has probably the widest selection of tradable stocks of any UK online investing platform.

- Extremely user-friendly interface which is suitable for an investor at any level. Also has a mobile app.

- Free to buy into funds ( you also get a discount for buying funds with HL; lower annual fund charge).

- Offers free investment guides and tools.

- Great Customer service

- All main account types – Dealings Accounts, ISAs, JISAs, SIPPs even actively managed cash accounts.

- No Transfer Out Fee

Disadvantages of Hargreaves Lansdown are:

- High Costs – They charge £11.95 per trade and also charge a fee of 0.45% for assets under management, this makes them more suitable for higher net worth investors.

- “The Wealth 50″ – Hargreaves recommended funds guide can be misleading as seen by the Woodford debacle.

YouInvest – In my personal opinion the closest challenger to Hargreaves Lansdown. It has many of the same attributes as HL but it is slightly cheaper. They have more than 232,000 customers and assets under administration exceed £50 billion. Their unique selling point is that they provide award-winning investment products, backed up with excellent service and online functionality at a low cost

AJ Bell Youinvest was recently recognized as a Which? ‘Recommended Provider’ for 2019 and commended for its ‘highly functional service’ and ‘value for money range of investment options by the consumer organisation.

In 2019 Youinvest also retained top spot in Platforum’s UK D2C Investor Experience report, which looks at the customer experience of investing and how it has evolved, in addition to receiving a further 11 industry awards.

It is also pleasing to see that in the company’s annual customer survey we achieved the highest service scores ever in response to the question, “How easy is it to use AJ Bell Youinvest?”

Advantages of Youinvest are:

- Low Platform fee – This is crucial for long-term and buy and hold investors as the cost savings could lead to higher compounded returns in the future. (The list of charges can be found here)

- User-friendly interface which is suitable for an investor at any level. Really Good mobile app

- Good customer service

- Great Range Of stocks

- Free shares magazine for accounts with balances(values) over £4,000. I have been told by friends that this magazine is really good.

- All main account types – Dealings Accounts, ISAs, SIPPs

Disadvantages of YouInvest are:

- Charges a fee of £4.95 to buy into funds

Degiro – if you’re a small-time investor looking to save money on fees, this is the place. Unlike Freetrade, it is not free. But it does offer competitive dealing rates at £1.75 a trade.

Advantages of using Degiro over other platforms:

- Low fees – not as low as a Freetrade but more competitive than most providers

- Fractional Investing – You can for example, buy 0.100 of a share in Google. If you were to do this for the entire NASDAQ, your portfolio would contain the equivalent of 0.100 of the Index. Ideal for investors with smaller portfolios who would like to spread their investments effectively.

- User-friendly web trader – Buying stocks is easy with Degiro.

- No Hidden costs – It’s free to open an investment account with DEGIRO.

- The pricing structure is simple and transparent with no hidden costs, so you know exactly what you are paying for and when, avoiding any unpleasant surprises.

Disadvantages of using Degiro:

- No analysis tools as you might expect from a discount broker.

- No trade confirmations – When orders are executed there is not such thing as trade confirmations in your mail. Everything is just on the platform itself.

- To deposit money, you can not do a simple debit card payment but you have to instead do a transfer from your bank to theirs.

- No ISA or SIPP – Degiro does not at present allow you to open an account with an ISA wrapper

IG – Founded in 1974 and respected as one of the most trusted brokers in the world, IG offers competitive commissions on shares of £5.00 – £8.00 per trade, brilliant trading tools, a proper mobile app, and share dealing across 19 international exchanges

Advantages of IG are:

- Great Trading Tools

Disadvantages of IG are:

- High costs at £8 a trade, reducing to £5 for frequent traders

- High custody fees at £24 per quarter

Interactive Investor – Trading Fees start at £3.99 per trade. Platform fees of £4.99 a month for portfolios under £50k – but you do get one free trade a month so provided you only trade once a month it could be cheap as your platform fee essentially becomes £2 a month.

Advantages of II are:

- Competitively priced platform

Disadvantages of II are:

- Could tempt you to overtrade with the one free trade a month offer.

The above are online share dealing platforms that allow you to easily buy and sell shares in your favourite companies.

Whichever brokerage firm you decide to work with, the actual process of buying shares will be similar. We will look at the process in the next lesson. The lesson will cover how to actually pull the trigger and buy shares as well as give an explanation as to the different types of orders when buying or selling a stock.