I used to be one of those people that was sceptical about opening a stocks and shares account or investing in a fund because the high fees were daunting. I had the mindset of most and kept thinking why I should pay astronomical fees even if the fund I was invested in was doing badly. Then I came across a platform called Nutmeg and I was already sold by the low fees and easy to use platform.

Nutmeg was launched in 2011 and it has been branded as the new way to invest. The company has embraced technological change and made an easy to use online platform. World-renowned economist John Kay was so impressed by Nutmeg that he decided to invest his own money in this venture. Nutmeg also counts asset management giants Schroders and Balderton as its shareholders so this is not one of those funds that will disappear overnight.

Nutmeg at a Glance

Types of Account supported

- ISA

- Standard Non-Isa

- Pension

Features

- Automated portfolio rebalancing

- Goal setting

- Choose your risk level

- Customized portfolio

- Automated deposits

Fees

The fee level changes depending on the amount you have invested.

- Less than £25, 000. 1% fee. No other charges

- As the amount you have invested with Nutmeg increases, your fee level will drop with the minimum fee being 0.3%.

- The good thing is that this is the only fee you will ever pay (unless you want to take your money out in a super-express way). Money withdrawals when it’s time to rebalance your portfolio (every 14 days ) is free.

Who is Nutmeg good for?

- Financial Investors looking for an easy investing approach, the best bang for their bucks and the best time savings. This group may be intimidated by starting an investment program, and may not want to invest all their time to figure it out. This group may be young millennials skeptical of high-priced financial advice, or busy older professionals who need to get started on their retirement savings.

- Long-term passive investors with some financial knowledge. The so-called “Planners and Forgetters.” These types of investors understand how to be patient with their money. They understand the concepts behind portfolio diversification and how fees impact long-term returns.

Who is Nutmeg Not good for?

- People who think they can beat the market, or want to trade individual stocks. – As Nutmeg will look after your portfolio for there is nothing for you to do investing wise. Thus if you think you can consistently beat the market, then this service is not for you.

What assets nutmeg will invest in for you:

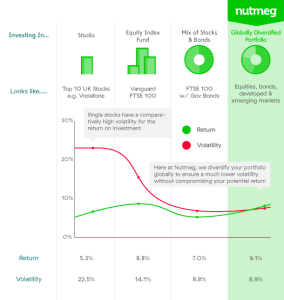

Nutmeg uses modern portfolio theory (MPT) where you can attain a higher return for a set amount of risk through diversification of assets.

How does Nutmeg work?

What struck me about joining Nutmeg is its ease of use and its simplicity.The website has essentially 10 different funds which are assigned to 10 different risk groups. Nutmeg believes that all investors fit into one of these 10 risk groups.

Funds are compromised of a variety of shares, bonds and other financial instruments. So for example, if you are very risk averse or nearing retirement and want to preserve your money, you will be given a risk level of 1 (or 2) and thus your fund will be mainly compromised of numerous government and corporate bonds, UK equities and money market funds.

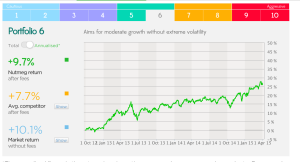

If you are like me and don’t mind a moderate amount of risk, you can join risk group 6 (fund 6) which is made up of both UK and foreign government bonds, UK and overseas equities and a mix of commodities. Fund 10 is naturally for those who are risky and have a long time frame of investment. Fund 10 includes equites from UK and abroad as well as a mix of commodities and property. Fund 10 has produced the highest return of the lot averaging 10.6% over the last year but it is also the most volatile.

When you first go to the website, you will be asked a number of questions relating to how you feel about money and the time frame you have for your investment to grow. The answer to these questions will determine your level of risk and this will give you an idea on which risk group you belong to as mentioned above. It is up to you to stick with the suggested risk level but you can change it if you like (yes, you have a choice!).

When I did this questionnaire, I was placed in risk group 6, which put me as someone who is looking to aim for moderate growth without extreme volatility. This assessment was spot on as I am naturally a cautious person and thus I decided to stick with this risk level and invested in fund 6.

Once you pay the money for your fund, which could be a lump sum or a monthly amount, you don’t have to do anything except watch your money grow. The nutmeg team takes care of everything from that point as they will invest in various financial instruments and also re-balance your portfolio on your behalf. The website also allows you to sign in online in order to see your portfolio. This is a very handy tool as you can see exactly what sorts of financial instruments you are invested in. This is all done for a low fee of 1% of your capital and that’s it, no hidden fees.

I have so far been impressed with the returns as I have gained an annualized rate of 8.2% on the money invested and this beats the market returns for this level of risk. What is even better is that my investment is in the new NISA and thus as it is under the £15,000 limit, whatever returns I make will be tax free.

I have so far been very happy with Nutmeg and I would recommend this site to anyone looking to take their first leap into the world of investing or anyone who wants to instantly diversify their portfolio.

Nutmeg is the only platform of its type I have seen online with its simplicity. A recent alternative to Nutmeg is InvestYourWay which has come across from the United States but I believe it still has a long way to go to catch up to the runaway success of Nutmeg. InvestYourWay uses CFD’s whereas Nutmeg uses ETFs as the means for purchasing equities. Furthermore, InvestYourWay requires a minimum £2,500 investment.

(P.S: TopCashBack and QuidCo currently have an offer whereby if you open an account and invest with Nutmeg through them, they will give you cash-back. The TopCashBack and QuidCo deal gives you £100 if you invest £5000 or more.)

Good Article. I have been using Nutmeg for over a year now and just love this new hassle free way of investing!

Is investing through this platform limited to UK residents only or is their service eligible for an investor living abroad?

Hey Prakash. As far as I am aware, you can as an overseas investor invest via the General Account type (You can always ask the nutmeg team for confirmation – they are extremely helpful). However, you cannot invest through an ISA or Pension unless you are a UK resident.