Disclaimer: This content includes financial promotions. We at investingintheweb.com will be paid a referral fee if you open an account and deposit funds through some of the links on this page.

Investing can be intimidating. Between complex platforms, high fees, and lack of guidance, getting started in the stock market is a challenge for many beginners.

This is where Lightyear aims to shake things up. This Estonian startup launched its intuitive investing app in 2020 to make buying, selling, and managing stocks and ETFs easy and affordable.

But does Lightyear actually make investing easy for newcomers?

After personally reviewing dozens of similar platforms, I analyze Lightyear’s key features, pros and cons, account options, pricing, and more for you. I will help you evaluate if Lightyear delivers on its promise to simplify investing for newcomers and if it fits your needs before starting the investing journey on your own.

Let’s start our review!

What is Lightyear?

Key information

| Regulation | EFSA and FCA |

| Deposit and withdrawal fee | £0 (card top-up has a 0.6% fee) |

| Available deposit and withdrawal method | Bank, card, electronic wallet |

| Minimum deposit | £0 |

| Base currencies | USD, EUR, GBP, HUF |

| Available instruments | Stocks, ETFs, MMFs |

Lightyear is an Estonian and UK-based app launched in 2020 that allows you to buy stock with small fees. You can also invest in exchange-traded funds (ETFs). Lightyear claims to offer over 6,500 stocks and ETFs from 15 different markets, including the US, UK, Europe, and Asia.

What sets Lightyear apart from the competition? Primarily, it offers attractive interest rates on uninvested cash held in your account. The yield is 3.77% net for funds held in GBP (as of February 2026). It is hard to find a similar offering on the market.

Pros and Cons of Lightyear

Pros

- Can earn interest on uninvested cash balances, with rates up to 3.77% depending on the currency (as of February 2026)

- Easy and quick account opening process. Fully digital.

- Good mobile app that is user-friendly with a slick design. Has useful features like price alerts.

- Stocks and Shares ISA

- Access to over 5,000 international stocks, including fractional US shares.

- Can hold multiple currencies to avoid FX fees. The conversion fee is only 0.35%.

Cons

- Limited educational resources and tools for beginners.

- Customer support is only via email, no phone or live chat.

- Web trading platform has limited customizability and fewer features than the mobile app.

- Only stocks and ETFs offered. No access to other assets like options, or crypto.

Is Lightyear a Safe App?

Yes, Lightyear can be considered a secure app. In the European Union, it is authorised and regulated by the Estonian Financial Supervision Authority (EFSA) under licence number 4.1-1/31, allowing it to operate across the EU under passporting rules.

In the United Kingdom, Lightyear UK Ltd is authorised and regulated by the Financial Conduct Authority (FCA), with firm reference number 987226, and is registered in England and Wales under company number 14367910.

Lightyear has implemented asset safeguarding and security measures to ensure the safety of clients’ funds. Nevertheless, remember that Lightyear is still a recent company, and thus, it has a short track record of resisting times of turbulence.

In addition, as a Lightyear UK customer, you benefit from asset protection of up to £85,000, provided by the UK Financial Services Compensation Scheme (FSCS). This protection would only come into effect in the most extreme circumstances, if all existing safeguarding measures designed to protect your assets were to fail.

For your US securities, these are held with Lightyear’s US broker partner, Alpaca, which is regulated by FINRA. This means your US investments are protected under the SIPC regime, covering securities and cash up to $500,000 (including a cash limit of $250,000) in the event of Alpaca’s failure.

Products Offered by Lightyear

In Lightyear’s offering, we can distinguish four basic elements: stocks, ETFs, interest on uninvested funds and money market funds. Limited selection of asset classes? Simplicity often wins over overly complicated platforms.

- Stocks – Investors can access over 5,500 stocks from various global exchanges, including those in Europe, North America, Asia, and Australia. The platform features popular US companies and even allows for the purchase of fractional shares. European stocks include those listed on Euronext and Deutsche Börse. For the UK market, you can access instruments traded on the London Stock Exchange. As for the United States, stocks from the Nasdaq and the NYSE are available. Charge per order starts at 0.1% for US stocks with a maximum of $1, for UK stocks and European stocks it’s £1 and €1 respectively.

- ETFs – The platform also boasts a selection of over 300 ETFs covering a wide array of sectors, markets, and investment strategies. These ETFs come from leading providers like Vanguard, iShares, and SPDR.

- Interest on uninvested cash – Lightyear allows you to earn interest on uninvested cash balances, with rates that vary by currency. For customers resident in the United Kingdom, the current interest rate is 1.00% on GBP balances, while EUR and USD balances do not earn interest (0.00%), and HUF interest is not available.

- Money market funds (MMFs) – the instrument allows to invest in a larger basket of short-term bonds from governments and financial institutions. MMFs may not be accessible in every country where Lightyear has a presence, and the smallest sum required to initiate an order is $1/€1/£1. Lightyear annual fees go from 0.09 to 0.3% depending on the amount invested.

As I mentioned earlier, Lightyear lacks some financial products, such as cryptocurrencies, options, mutual funds, or bonds.

However, if you’d still like to try out these instruments, I have a few alternatives for you. Interactive Brokers can become your investment powerhouse for practically all asset classes, while Freetrade is a good choice for beginners. Check eToro if you are a crypto bug.

| Broker | eToro | Interactive Brokers | Freetrade |

| Products offered | Stocks, ETFs, Cryptocurrencies, and CFDs on stocks, currencies, commodities, and indices | Stocks, ETFs, Forex, Fund, Bond, Options, Futures, CFDs, Warrants, Structured Products | Stocks, ETFs, ETCs, Investment trusts |

| Minimum Deposit | $50 | £0 | £0 |

| Demo Account | Yes | Yes | No |

| Regulators | FCA, CySEC, ASIC | FSA, FCA, MAS, FINMA, ACPR, AMF, DNB, FSMA, NBB, SFC, ASIC | FCA |

How Much Does Lightyear Charge to Trade?

Many features on Lightyear are entirely free. The platform does not charge commissions for ETFs (if bought in the same base currency; otherwise, an FX fee applies), multi-currency accounts, securities custody, bank deposits and withdrawals, or US tax forms.

However, I checked, and some fees will be applied:

- Commission for US stocks: 0.1% up to $1 per order

- Commission for EU stocks: €1 per order

- Commission for UK stocks: £1 per order

- Currency conversion: Conversion occurs at the Interbank exchange rate, with a 0.35% commission

- Fast deposit: 0.5% per transaction (after the free 500 GBP limit)

- Money market funds: 0.09-0.30% annually, deducted from monthly distributions. (and fixed fee from Blackrock of 0.10%)

Let’s say you’re buying 3 Apple shares. One currently costs $178.73, so you’ll pay a total of $536.19. The commission for purchasing American stocks is 0.1%, so Lightyear will collect $0.54.

Available Accounts

Lightyear offers two types of accounts:

- a Personal one for individual investors;

- and a Business account for companies.

You may register a Legal Entity Identifier (LEI) in the Business account for €45 + VAT. Unlike the Personal, the Business account also offers the added benefit of treasury management for SMEs (limited to Estonia; in the UK, the offering is only for freelancers and sole director companies).

| Category | Personal Accounts | Business Accounts |

| Account Types | Personal accounts are for individual investors to invest their own money. | Business accounts allow companies to invest their business funds. |

| Fees and Minimums | No minimum deposit and low trading fees. | No minimum deposit and the same low trading fees as personal accounts. |

| Tax Treatment | Subject to capital gains tax on profits. | Investing is tax-free as a company. Profits are taxed when withdrawn. |

| Account Features | Offers features like multi-currency support. | Offers the same features as personal accounts, plus high interest on uninvested cash. |

| Account Opening | Can be opened instantly online. | Requires more documentation, such as proof of business registration. |

Stocks and Shares (and cash) ISA at Lightyear

Lightyear offers two ISA products for UK residents: a Stocks and Shares ISA and a Cash ISA. Both are designed to help investors grow their money tax-free, but they serve very different purposes.

Stocks and Shares ISA at Lightyear

The Stocks and Shares ISA is ideal for long-term investors who want to invest in the markets while benefiting from the UK’s ISA tax advantages.

With a Lightyear Stocks and Shares ISA:

- You can invest in UK, US, and European stocks and ETFs

- All capital gains and dividends are tax-free

- You pay the same low trading fees as on a standard account

- Fractional shares are supported (including US stocks)

- There is no minimum deposit

This account is particularly attractive to beginners and passive investors looking to build wealth over time without worrying about capital gains or dividend taxes.

ISA allowance reminder: You can invest up to £20,000 per tax year across all your ISAs combined (as of the 2025/26 tax year).

Limitations to note: Only stocks and ETFs are available inside the ISA, money market funds (MMFs) are not available within the ISA wrapper and no Lifetime ISA or Innovative Finance ISA.

Cash ISA at Lightyear

Lightyear also offers a Cash ISA, which is suitable for investors who prefer capital protection over market exposure.

Key features of the Lightyear Cash ISA:

- Earn tax-free interest on GBP cash balances

- No risk from market fluctuations

- Counts toward the same £20,000 annual ISA allowance

- Easy access via the same Lightyear app

The Cash ISA is best suited for: short-term savings goals, emergency funds and investors who want certainty rather than volatility. Unlike the Stocks and Shares ISA, the Cash ISA does not allow investing in stocks or ETFs, funds remain held as cash only.

Who should choose which ISA?

- Choose the Stocks and Shares ISA if you’re investing for the long term and can tolerate market ups and downs.

- Choose the Cash ISA if you want a safe place to hold cash and earn tax-free interest.

- More experienced investors may even combine both, as long as they stay within the annual ISA allowance.

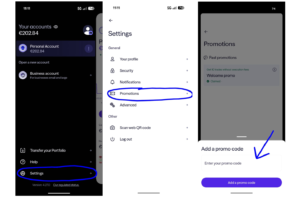

Lightyear Promo Code: Get up to £100 in a US fractional share

| Lightyear Promo Code | |

| Promo Code | MONEYGROWER |

| Lightyear Bonus | Get up to £100 in a US fractional share to your GIA. |

| Conditions | You must be a new user and deposit at least £100 within the first 15 days after onboarding. |

Capital at risk. Terms apply: https://lightyear.com/en-gb/signup-promotion-terms. You must be a new user and deposit at least £100 within the first 15 days after onboarding. The reward can be withdrawn 6 months after it’s credited.

To participate in Lightyear’s Promo Code and get 10 trades for free, you’ll need to follow these steps:

- Sign up to Lightyear using the code MONEYGROWER.

- You must be a new user and deposit at least £100 within the first 15 days after onboarding (the lockdown period for the reward is now 6 months).

- Get up to £100 in a US fractional share to your GIA.

Lightyear Mobile vs. Web App

Lightyear offers access to two platforms: a mobile app and a web application.

What can you find inside it? Let’s check:

- A user-friendly and well-designed interface

- A good search function to find stocks and ETFs

- Available price alerts

- Easy account opening

- Quick deposits and withdrawals

The web application offers several features, such as:

- Analyst ratings: price targets from a different set of analysts, including buy/hold/sell recommendations

- Financial metrics & earnings data: dig into company performance on a quarterly or annual level

- All available cash deposit options: you can choose the most suitable option for you

- News and lightning updates: stay on top of what causes stock price movements

- Limit and stop loss orders: automate your trading from the comfort of your computer screen

Customer Support

Lightyear does not offer the option of phone or online chat support with customer service. The only available form of contact is via email (at support@golightyear.com).

I checked if it was sufficient and contacted support directly. Although the response was satisfactory, the waiting time was slow. Moreover, the support is definitely not available 24/7.

If you want to get an answer faster, check out the help section on the official website. Personally, it has helped me solve a few unknowns.

On Trustpilot, Lightyear has received high praise, boasting a 4.7 out of 5 stars based on over 2,000 reviews. An impressive 98% of these reviews are four or five-star ones.

What were the dissatisfied customers complaining about? Among other things, they mentioned the limited form of contact with customer service and the quality of the help itself. However, my experiences have been mostly positive.

To Sum Up

Lightyear is still a relatively new app that offers a simple and cheap way to invest in the stock market. Could be suited for investors who want to buy and sell shares and ETFs worldwide without paying any fees.

If you’re just starting out, you should totally give this app a shot, especially because it pays interest on the money you’re not using at the moment. But if you’re a seasoned trader, there are cooler options out there with more tools and trading instruments to play with.

For low commission and a wide variety of products, you can check Interactive Brokers and eToro.

FAQ

How much does Lightyear charge to trade?

Lightyear provides an execution-only brokerage service through its mobile app. As stated in their Terms of Service, Lightyear does not charge execution commission on ETFs, but will charge some fees on stock trading.

How do I transfer shares in Lightyear?

You can transfer your stocks purchased with another broker to a Lightyear account. It is available for all European and UK stocks on the platform. Remember that your current broker may charge a transfer fee.

Is Lightyear a good broker?

Lightyear provides an easy-to-use mobile app for basic investing focused on share and fractional share purchases. As an execution-only brokerage, they do not provide investment advice. Lightyear seems suited for beginner investors looking for a simple experience. More advanced traders may prefer a full-service broker.

Is the Lightyear app free?

Yes, the Lightyear app is free to download and use. You will pay some fees on your stock transactions and on currency transfers.

Is Lightyear a private company?

Yes, Lightyear is a private company not publicly traded on a stock exchange.

How many customers does Lightyear have?

Lightyear has not publicly disclosed its number of customers or user base. As a private startup company, this information is not readily available.

Who owns the Lightyear app?

Lightyear is owned by Lightyear Europe AS, which is authorised and regulated as an investment firm by the Estonian Financial Supervision Authority (Finantsinspektsioon) under activity licence number 4.1-1/31. Lightyear Europe is a company registered in Estonia with company number 16235024 and registered office at Volta 1, Tallinn 10412, Estonia.

Lightyear Financial Ltd is authorised and regulated by the Financial Conduct Authority (FCA) under firm reference number 955739. Lightyear Financial Ltd is a company registered in England and Wales (company number 12925823), with its registered office at 256–260 Old Street, London EC1V 9DD, United Kingdom. Lightyear Financial Ltd is listed on the Financial Services Register maintained by the FCA.

Is Lightyear profitable?

As a private company, the profitability of Lightyear is not public information.