Have you ever wanted to escape the rat race? To achieve financial independence, retire early and live life on your own terms? Well, it might be time for you to join the FIRE movement that is sweeping across the UK.

What is the FIRE Movement?

The FIRE movement is a group of personal finance enthusiasts looking to achieve financial independence in the shortest time possible. Through a combination of frugality, aggressive saving and smart investing.

What is Financial Independence Retire Early (FIRE)?

Financial Independence Retire Early, or FIRE for short, is saving money at a high or accelerated rate to build a pot of money you can retire early with.

When you typically think of someone who does with their day as they please without money worries, your mind automatically focuses on oldies living off their pensions.

But many people don’t want to wait till they are almost dead to start enjoying their life.

They want the freedom to do whatever they want with their lives now whilst still young, fit and healthy.

And this is where FIRE comes in.

Fundamentally FIRE is about the flexibility of not having to work for money. Giving you complete freedom to do as you please with YOUR time.

Live Frugally today for Financial Freedom Tomorrow

FIRE followers typically stick to a very strict budget and live a no-frills lifestyle.

It’s about making sacrifices today to achieve financial independence decades before the normal retirement age.

The easiest way to become financially independent and retire early is to ensure you have an economical and frugal lifestyle.

You need to learn to live on less. The reason for this is twofold.

By living frugally:

You are able to save and invest a good proportion of your income whilst still in the first stage of your journey which is to build a decent size investment portfolio.

Once you retire, you are already used to living frugally so you don’t need as much passive income to live on. This again cuts down the amount you need to save away in your portfolio and you can retire early much faster.

Most people in the FIRE community agree that you need to be saving at least 50% of your annual income but some save as much as 75%!

In order to have this high savings rate, you need to start keeping budgets and sticking to them. You need to stop going out for those expensive meals and instead start cooking at home. You may have to sacrifice certain holidays and trips. Cut out the fat from your budget and reduce unnecessary expenditure.

The FIRE lifestyle is all about desperately toeing the line between extreme frugality and being straight-up cheap, to the point where you decline social events in order to avoid spending money on gifts or going out. To make it work, you must really want it to work, more than you want beers on a Friday night or even a Netflix subscription.

This is the trade-off for wanting to retire early. The frugality necessary for a successful FIRE lifestyle discourages many.

You have to really, really want financial freedom over the urge to have a good lifestyle now.

How much income do I need to retire early in the UK?

This is a question that offers significant debate in the FIRE community as there is no one standardised answer. Everyone’s circumstances are different, it all depends on how much you feel you might need to live a comfortable existence.

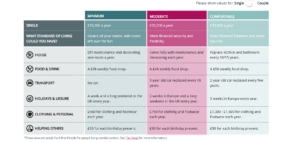

To give you a better idea of what you might need retirement living standards have provided examples of three different standards of living. These are based on a single person and a minimum, moderate and comfortable standard of living.

A “minimum” lifestyle covers basic needs, with some leftovers for fun and socialising. You could enjoy a staycation in the UK, eat out about once a month and do affordable leisure activities about twice a week.

Income needed = £10,200 per annum

A “moderate” lifestyle provides you with more options. You could have an annual foreign holiday and eat out a few times a month. You’d have the opportunity to do more of the things you want to do.

Income needed = £20,200 per annum

A “comfortable” lifestyle allows you more luxuries You could have a subscription to a streaming service, regular beauty treatments and two foreign holidays a year.

Income needed = £33,000 per annum

The possibility of enjoying a life of leisure on only a few hundred pounds makes FIRE even more attractive and accessible to the average earner. In fact, the less accustomed you are to a high income and thus high spend lifestyle, the more likely you are to be able to afford it.

How much do I need for early retirement in the UK?

As a rule of thumb, you can use the 25X multiplier to determine how big a lump sum you will need for early retirement.

Once you have worked out the annual income required based on the data above, you simply times that by 25.

For example, based on a moderate lifestyle and income of £20,200 per annum the total lump sum needed would be £505,000.

£20,200 X 25 = £505,000.

Alternatively, if you already have an investment portfolio and want to know how much income that could generate you can use the 4% rule.

The 4% rule is touted as a safe rate of withdrawal from a stock investment portfolio each year, taking into account market slumps and inflation.

The rationale is that if you withdraw no more than 4% of the total value of your investment each year the fund would never run out in your lifetime.

So if you have an investment portfolio of £505,000 and take 4% each year, you would arrive at £20,200.

£505,000 X 4% = £20,200.

Essentially the 4% rule is the 25X multiplier reversed.

Whilst a figure of £505,000 might sound monumental right now and impossible to achieve, it is much easier to get to than you think.

You need to understand that as you are saving and investing to reach this amount, your portfolio is working for you all the while. Your portfolio is working for you long before you hit £505,000.

If you’ve only banked £300,000, it’s still growing by £25,000 to £30,000 (or more) all on its own without you having to save any more money. One of the things that make FIRE possible is once you commit to it and do the legwork at the beginning, your savings really start to snowball.

Your first £100,000 in savings is the hardest, whether FIRE is your goal or not. Once you reach that magical £100k investing mark, you will see how your portfolio will rocket higher by simply reinvesting any dividends you receive. The compounding power this brings is truly magical and you’ll see your portfolio grow at a pace that puts raises at your job to shame.

For this reason, if you’re on the fence about FIRE, at least follow the steps for it until you bank that first £100,000 in investible capital and then decide then if you want to commit for a few more years. Whether you’re FIRE ready or not, you need £100,000. Save it.

Alternatively, you can retire with a portfolio value of much less if you generate passive income via other sources or don’t need as big an income. Shifting your passive income requirement to a minimum income requirement of £10,200 – still a decent amount – will only require a portfolio value of £255,000 using the stock market 4% method.

Usually, the people that seek and achieve FIRE in the UK are doing it on modest six-figure sums, not copious millions.

How do I start my FIRE journey today?

You can invest in the stock market via index funds, buy specific dividend-paying stocks, or generate rental income from properties you own or any of the other ways listed in my article titled: My top five income-generating assets actually worth owning.

From all the different ways you can generate passive income, investing in the stock market is one of the most common methods members of the FIRE community use.

Final Thoughts…

When I first came across the concept of FIRE, it was so intriguing to me because it was the first time I learned about people actually retiring early or becoming financially independent.

I thought I’d been prescribed a life where I had to work until I was 67 (sigh!) or much much later, given the norms.

Once I found out that people were challenging the status quo and living life on their own terms, I got extremely excited about my future.

For me, the idea of financial independence is extremely appealing. I would love to have total freedom over the work I choose to do and never do things just for the money.

So whilst pursuing FIRE is 100% optional, pursuing the FI? part of it really isn’t, at least for someone that wants greater control over their time and greater freedom with their life.

So even though I don’t plan on retiring early, I just want to become financially independent due to the options it brings.

Even though I am a number of years away from financial independence, the concept of FIRE has been embedded in me.

How about you? Intrigued about FIRE and want to learn more…

What level of financial independence are YOU aiming for?

Continue reading and find out more about the 7 Levels of Financial Independence.

[optin-monster slug=”rkitlhn3pm1oj2hm7yt9″ followrules=”true”]